Diversify Your Portfolio By Supporting Small Businesses

Get More Information Delivered Right to Your Inbox!

What Is A MCA?

A Merchant Cash Advance (MCA) is a financing option for businesses in which a company receives a lump sum of capital upfront in exchange for a percentage of their future debit or credit card sales, plus a fee. This is typically used to increase working capital for businesses to cover cash flow gaps.

Here's How It Works:

MCA Financing Company

A business receives the cash it requires upfront in agreement with the MCA financing company, and the funds are deposited into the business's bank account.

MCA Imposes Fees

The MCA imposes fees, and instead of employing an interest rate, MCAs typically employ a factor rate, which is multiplied by the total loan amount. For instance, a $100,000 advance with a factor rate of 1.4 would result in a total cost of $140,000.

Business Makes Repayments

The business makes repayments based on its future sales, which are often made on a daily basis, although some MCAs offer the option of weekly payments. The advance is settled once you've paid back the borrowed amount, the factor rate, and any additional fees agreed upon.

Key Takeaways

A Merchant Cash Advance Forwards Cash Against Future Sales.

This Type Of Business Financing Is Easier To Qualify For Than A Typical Loan.

MCAs Have Aggressive Repayments That Disrupt Profitability Until It’s Repaid.

Borrowing Fees Are Typically High With Rates Often Ranging From 50% To 100% Or More.

Why Invest With Us?

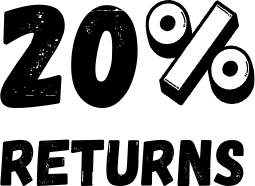

High-Yield Returns

As an investor, you will receive a fixed annual return of 20% on your investment, ensuring an attractive income stream.

Empowering Small Businesses

Your investment directly contributes to the growth and success of small businesses, fostering economic development.

Expertise and Reliability

You have the assurance of a highly experienced team with over 6 years experience dedicated to this industry.

Investment Terms

Monthly interest payments with the principal amount returned after just 12 months.

Personally Invested

Each one of our team members is personally invested in this business and will continuously be financially involved alongside you.

Show Me The Numbers!

We’ve taken the extra step to make sure every investor has a clear picture of what they’ll see in return for working with us. Choose your desired investment amount below and check out your returns.

How We Operate

Funding businesses

Small businesses typically cannot obtain traditional financing from a bank nor can most newer businesses (6 months – 3 years in business) or business owners with bad credit. This is for people who may need a deal to start a relationship and build a payment history or someone who needs a second chance. It can also be for people that have other financing (factoring, bank loan, SBA loan, equipment lease, etc.), but cannot get any additional funds from their institution. A business owner may have an opportunity to buy a new truck or piece of equipment, but cannot wait for the bank. That is where we come in.

Criteria

We look for businesses that are depositing at least $5,000 – $10,000 a month consistently depending on their industry. We also look for the amount of deposits (as an example: a business that makes a deposit everyday is better than a business that relies on one or two deposits a month). Average daily balances in their account are important because that will determine how much money they should normally have in their account to insure that they can afford making the payments. We also look at payment history with other companies if it applies, and what their revenue is compared to debt.

Deal Sizes

We fund between $1,500 – $50,000 per deal depending on liquidity, cash flow, and other factors. Generally the deals are $10,000 and under. We aim to spread the money into as many deals as possible to diversify and help mitigate risk.

(As an example: If we have $100,000 available to fund on a given day, we would rather fund 20 $5,000 deals and spread out the risk.)

We Supports Small Businesses

Get In Touch

If you are facing any problems or have any queries then you can simply leave us a message or contact us our team will get back to you as soon as possible.